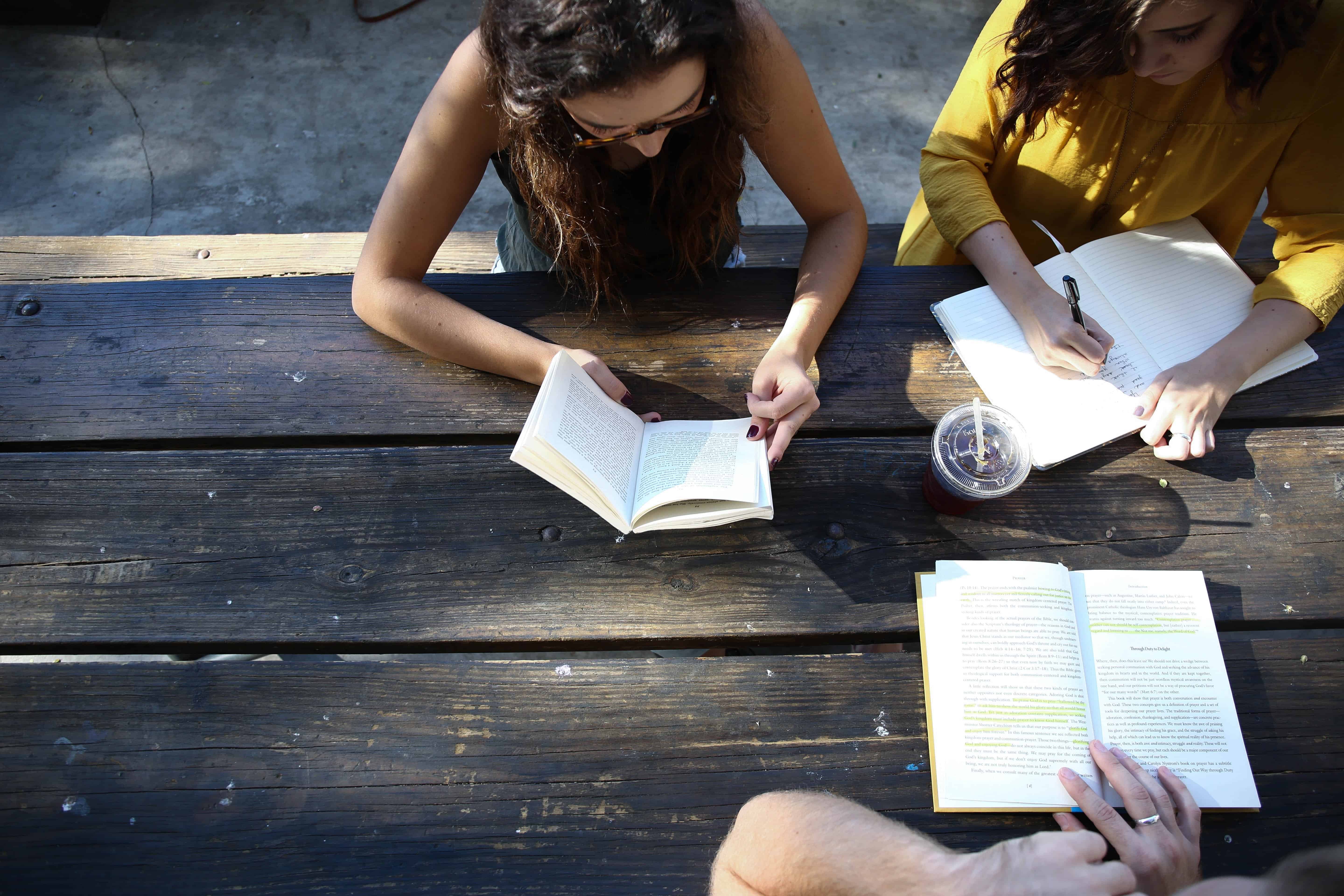

Each Faith Ventures plan comes with a comprehensive description of coverage that details the policy. Reading carefully through the description of coverage will go a long way in avoiding issues with claims. The description of coverage includes:

Schedule of Coverages & Services – Look here to see exactly what you’re covered for. Make sure the maximum dollar amount seems reasonable for your travel needs.

List of Definitions – Refer back to this section if you come upon a capitalized term in the policy that needs further definition.

Summary of Coverages – This section includes details on each area of coverage, including Trip Delay, Baggage & Personal Effects Loss, Baggage Delay, Passport Replacement, Medical Expense Benefit, Emergency Evacuation & Repatriation of Remains, and Accidental Death & Dismemberment. Look especially for notes on proper procedure.

General Exclusions – This section is very important to read carefully. Find out what the plan doesn’t cover: losses caused by or resulting from the listed items.

General Provisions – These are miscellaneous regulations that apply to the protection plan contract, mostly legal related.

Claims Provisions – Very important! This section describes Arch Insurance’s claims process.

Security Assistance Services – Provides a description of Political Evacuation and Natural Evacuation coverage and exclusions.

Travel Assistance & Concierge Services – This section details the 24/7 medical and travel assistance services that are provided with Faith Ventures.

Contact Info – Refer to the last page of the description of coverage for the 24/7 emergency contact phone number and travel assistance hotline, as well as numbers for claims inquiries and policy questions.